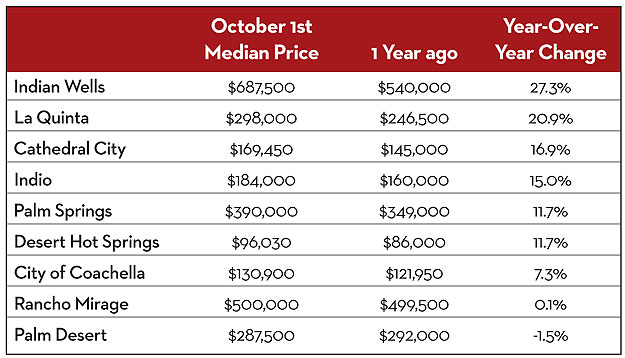

From statistics, we know the bottom for home prices throughout the Coachella Valley generally occurred in September 2011. Because of this, home prices as of Oct. 1 are ideal to show the year-over-year percentage change. The table below shows the Oct. 1 median price for each city against the median price on Oct. 1, 2011. The increase in some cases is dramatic, with the largest gain by Indian Wells, followed by La Quinta, Cathedral City, and Indio.

We expect home prices to continue to rise over the next 18 months — perhaps by another 15 to 20 percent driven by record affordability and declining distressed sales.

The inventory of homes for sale explains everything. Twenty months ago, the listed inventory of homes was 6,000, which included normal and distressed properties. Now the total is only 2,800 homes.

Remember that home prices can advance for two reasons: either lots of buyers or very few sellers. In this market, the situation seems much more the latter than the former. This should be considered positive, however, because a price base that forms this way is usually more certain and longer lasting.

We have projected the end of 2013 as the depletion date for distressed property in the Coachella Valley. However, if a new program from Fannie Mae works, it might occur sooner.

The government-sponsored Fannie Mae and Freddie Mac own or control 90 percent of mortgages in the country. The first recently began a program to rapidly get rid of distressed property in a way that will not put downward pressure on home prices. The program sells huge pools of foreclosed properties to large corporate investors. The initial deal, completed in September, sold 699 foreclosed properties in Florida to a real estate investment trust in San Diego. Historically, these pools are almost always auctioned or sold one at a time to individuals.

The program is controversial and a little secretive. Freddie Mac announced it will not conduct a similar program. The California Association of Realtors contends it will hurt the market. It will definitely hurt their income, as these properties are sold directly to big investors; they do not go through a broker or the Multiple Listing Service.

If the program takes off, we may see the positive effect of having few low-priced, distressed houses in the MLS faster than we thought. While there are possible downsides to the program, it would initially push home prices higher. With higher prices, home equity will return, and the need for short selling will abate.

Will these investors then re-create the inventory problem by dumping these houses back on the market? A few probably will. However, most will hold the properties for some time. Warren Buffett points out that real estate is by far the best investment right now. If an individual or corporate investor can put 20 percent down, borrow at 3 percent and rent at 5 percent, they earn an 8 to 10 percent return with little risk.

Vic Cooper and Mike McDonald are partners in Market Watch LLC, a nationally recognized real estate advisory company that produces The Desert Housing Report. Visit www.marketwatchllc.com.

* We use three-month averages to help reduce small sample and seasonal variation.

See More Market Watch Articles Here