With Coachella Valley real estate numbers in for December, we can summarize 2012 and project a clearer view of what to expect this year.

The first chart shows that home prices throughout the Coachella Valley, as measured by price per square foot, rose to $130 from $105 by the end of 2012. This 24 percent increase in one year was the greatest percentage gain in more than eight years. If you worry that this might be the start of another bubble, rest assured there is no indication of that. The evidence does show that this is the beginning of the long-awaited housing recovery.

One important improvement last year was the large decline in the number of distressed properties sold through the Coachella Valley. At the beginning of 2012, about 50 percent of all sales were either bank-owned foreclosures or short sales. By the end of last year, distressed properties accounted for only 30 percent of sales. If the rate continues to decline — and the evidence points to that — foreclosures should cease to be a problem here by late this year.

Most observers wonder whether last year’s price gains will continue this year and into next. We believe they will. The forces of supply and demand, which drive the prices of all markets, appear more positive than ever for desert housing.

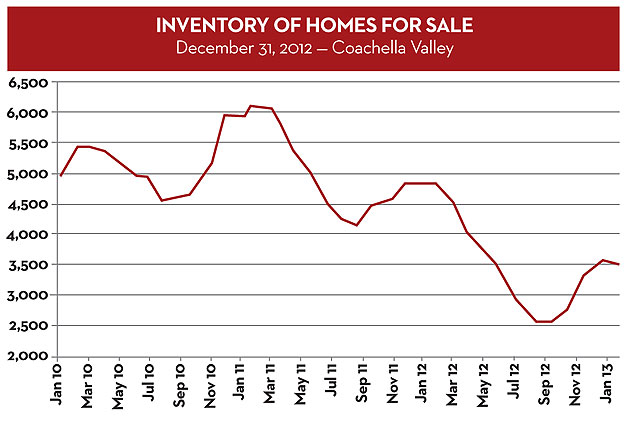

The supply of houses for sale — only 3,500 units for the entire Coachella Valley — is near all-time lows (see MLS Inventory of Homes for Sale). Because this inventory includes distressed homes, and the number of distressed sales will continue to shrink, we can expect pressure on inventories to remain low even as prices rise.

If we measure buyer demand using the Riverside affordability index (a reading of 62 percent), it, too, is near all-time highs. It is even higher than 62 percent, because the index is calculated using the median income of Riverside County, and more than 50 percent of buyers come from regions outside the Coachella Valley with a higher median income.

While the affordability index measures the capability of homeowners to buy, it doesn’t directly measure willingness to buy or whether would-be buyers are in a position to make the transaction. For example, someone may be qualified income-wise to a buy a home, but unable to buy because they’re underwater on an existing home. This has been the problem for Coachella Valley real estate. Thirty percent of Southern California homeowners who usually purchase in the Coachella Valley have been unable to do so because of the negative conditions of their own home markets. However, this situation is changing as their home markets improve.

MarketWatch sees a solid foundation to continue the price gains of 2012. An unleashing of four years of pent-up demand is producing a continuous stream of buyers looking for a home from a limited supply.

Vic Cooper and Mike McDonald are partners in Market Watch LLC, a nationally recognized real estate advisory company that produces The Desert Housing Report. Visit www.marketwatchllc.com

See More Market Watch Articles Here